Financial Preparation In Your 20'S

Financial Preparation In Your 20'S

Blog Article

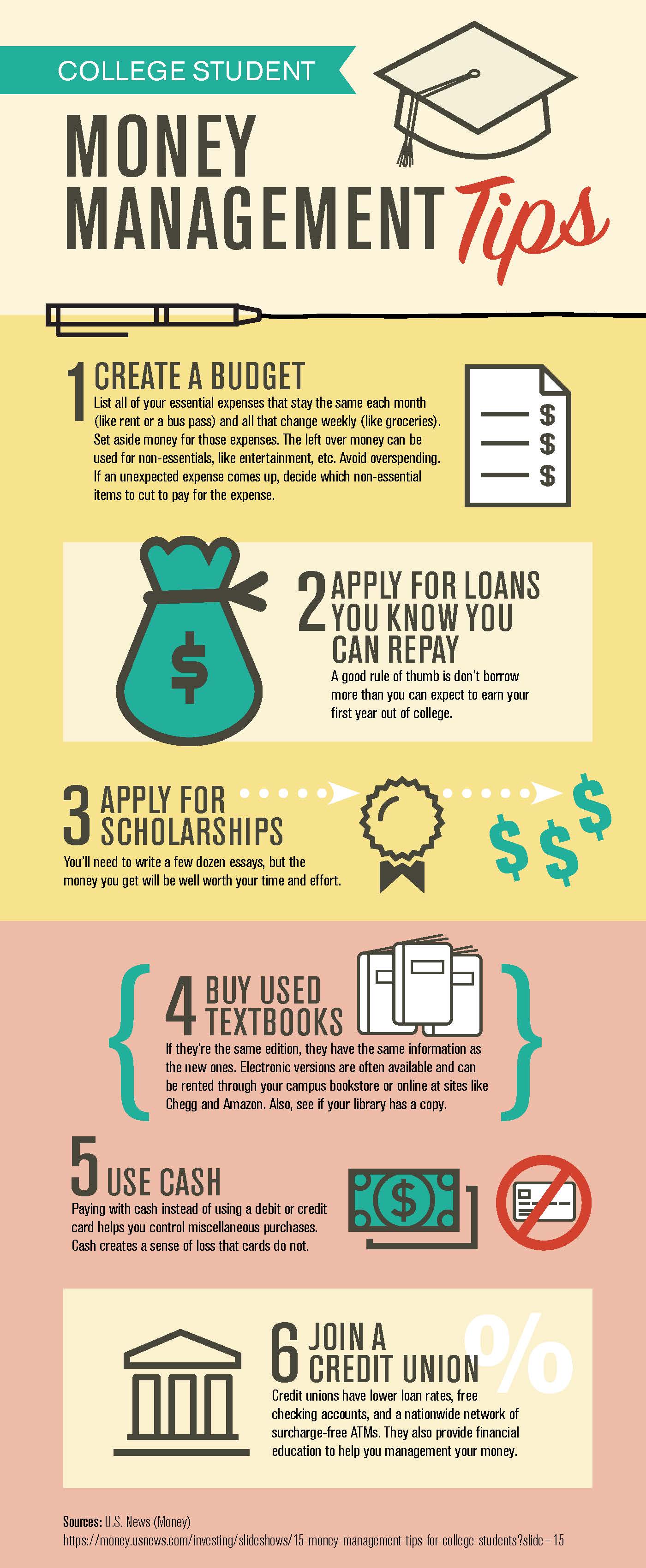

I have put this article together for the purpose of providing you three simple to follow suggestions, which will provide you a kick start on your method to monetary independence. These tips will conserve you some cash right away if you begin applying them today. For that reason they are an excellent start, and as soon as you are made with them you can proceed to more advanced strategies. So let's begin!

If you can open up to a household member or good friend it is best to do so, and certainly if somebody else is personally involved it is best in the long run not to conceal things. Be specific that your confidant is in fact able to help, there is absolutely nothing worse than taking financial suggestions from somebody that is poor at handling money themselves.

Open a couple of monitoring accounts and get inexpensive individual check so that you can remain within your budget plan. One account could be used to cover fixed expenditures; another would be committed totally to variable costs. Having an extra account makes budgeting easier, and assists you to know what cash can and can not be invested.

Let's not worry just due to the fact that the market dropped, as the marketplace so often does, it fluctuates. Stick with it, you'll have lots of opportunity to sale high later. Ensure you have a diversity of liquid investments to benefit from when you retire, so you won't need to touch your retirement immediately. Remember you will not require all your retirement at 65, just part of it. That method the rest of your investment will have additional time to increase. Make certain you're purchasing something that permits you to sleep at night, and never put all your eggs in one basket. Know your tolerance for tension, you wish to live to retirement and remain in your right mind.lol.

You must understand that any kind of financial tips consultant job will need a great deal of salesmanship. You have to have self-confidence while letting your customers understand what investments would be best for them and in some cases it needs you to be a type of sales representative. Therefore, the person interviewing you wishes to see if you are confident and outbound adequate or not. You will be required to deal with customers one-on-one for the most part, so you'll need to be rather personable and friendly as well.

One way to avoid falling into the exact same mistakes is manage money making certain you have actually collected a cost savings account for those times of monetary emergency situations, before you get another card. Making a spending plan and living by it is the greatest way to understand just how much money you invest and how much can be saved.

Re-finance - Refinancing isn't the end all response to your financial problems. It can, nevertheless, make life a little simpler however conserving you a good offer of money. Do some research study on present mortgage rates and after that compare them with your home mortgage. If you discover you are paying a portion or 2 more than you should be, I advise refinance your loan. Another option is to refinance to one with a shorter term. This can conserve you thousands of dollars in long-lasting interest.

Report this page